Why We Ditched ClassPass

Why We Ditched the #1 Lead Gen Tool In Fitness

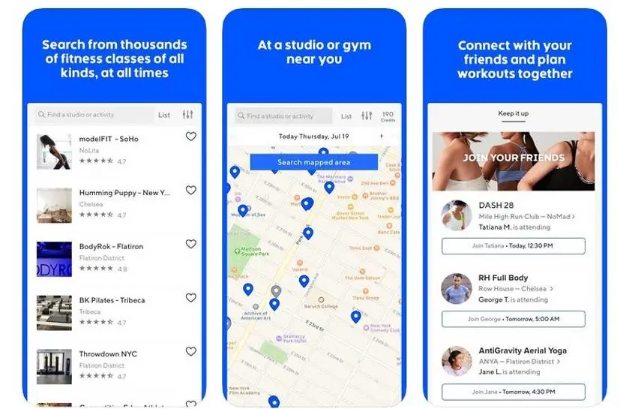

ClassPass is a subscription-based platform that allows users to book fitness classes at various studios for a monthly fee. Users purchase “credits” to access a range of classes across different gyms, yoga studios, and boutique fitness providers.

For studios, it acts as a lead generator, filling empty class spots and exposing their brand to new customers. It is perhaps the most utilized lead generation software in the entire industry, driving the majority of their traffic from this discount-based program.

So why did we ditch it across all our studios? Why were we willing to take a 30% revenue haircut on Houston to move past it? How are we generating those lost leads?

Why Do Studios Use ClassPass?

ClassPass appeals to fitness enthusiasts who value variety and flexibility. It’s particularly popular in urban markets where users want to try different workouts without committing to a single studio.

For studios, ClassPass offers:

Increased Visibility: Exposure to a broader audience.

Filling Empty Spots: A way to generate revenue from unsold class slots.

Lead Generation: An opportunity to convert ClassPass users into full-time members.

However, many studios using ClassPass adopt a “class pack” focus, prioritizing short-term sales over building long-term memberships. This approach often overlooks the importance of nurturing leads into loyal, engaged members—a core pillar of our business model.

Why We’ve Chosen to Pass on ClassPass

While ClassPass may seem like an attractive option for some, we’ve carefully evaluated its impact and concluded that it doesn’t align with our mission or long-term goals.

Here’s why:

1. The Economics Don’t Add Up

ClassPass takes a significant cut of each booking, often leaving studios with a fraction of the revenue they’d earn from direct memberships. For TLS, it was closer to $8 a class vs the average of $21 per class. This model incentivizes studios to rely on volume over value, which erodes profitability. By focusing on direct memberships, we retain full control over our pricing and revenue, ensuring we can invest in high-quality instructors, top-notch facilities, and innovative programming.

2. It Undermines Our Membership Model

Our business thrives on fostering long-term relationships through personalized workouts. ClassPass users, by design, are transient—they’re encouraged to hop between studios rather than commit to one. This conflicts with our goal of building a loyal community of members who see our studios as their fitness home. Data from our internal analytics shows that members who commit to a membership, come 2x more often, see better results and stay 5x longer (Note: our average member stays for 29 months).

3. It Dilutes Our Culture

Our studios are more than just places to work out—they’re communities built on shared goals, accountability, and camaraderie. ClassPass users, who often prioritize convenience and variety, are less likely to engage with our culture or form meaningful connections. This can disrupt the sense of belonging that keeps our members coming back. By focusing on members who align with our values, we create an environment where everyone thrives.

4. It Hinders Long-Term Results

TLS is all about deriving results through personalized workouts. Fitness is a journey, and meaningful results come from consistency. ClassPass’s drop-in model encourages sporadic attendance, which can lead to lower member satisfaction and weaker outcomes. Our data-driven approach shows that members who follow our structured onboarding funnel and commit to regular classes see 2.5x better results in metrics like strength gains and body composition changes compared to occasional attendees.

Redesigning Our Lead Generation Strategy

Instead of relying on ClassPass to fill classes, we’ve invested heavily in our own lead generation and retention systems.

Here’s how we’re doing it:

1. Ad Optimization

We’ve refined our digital advertising strategy to target high-intent prospects who are likely to commit to memberships. By leveraging platforms like Google Ads and Meta, we’ve reduced our cost-per-lead by 30% over the past year. The chart below illustrates the impact of our ad optimization efforts:

2. Streamlined Onboarding Funnel

Our onboarding process is designed to convert leads into members efficiently. We offer trial memberships that give prospects a taste of our community and programming, with clear pathways to full memberships. Since implementing our new funnel, we’ve increased trial-to-membership conversions by 25%.

3. Data-Driven Results

We use data to track member progress and demonstrate the value of our programs. By sharing personalized progress reports with members, we boost retention rates by 15%. This focus on measurable results sets us apart from the transactional nature of ClassPass.

The chart below shows our sophisticated data analytics tool that optimizes leads and CPL (cost per lead) across all studios. ClassPass doesn't provide metrics close to this and most studios operate blindly, competing directly with other studios.

Conclusion

Partnering with third-party platforms like ClassPass can create a dependency that stifles innovation and long-term growth. When studios rely on external platforms for leads, they risk losing control over their brand, customer relationships, and revenue streams. At TLS, we’re committed to building a business that prioritizes long-term customers over short-term sales.

By investing in our own lead generation, optimizing our onboarding process, and fostering a vibrant community, we’re creating a sustainable model that delivers exceptional value to our members and strong returns for our investors. We believe this approach not only sets us apart in the crowded fitness industry but also positions us for enduring success.

Thank you for your continued support as we build a fitness brand that transforms lives and redefines what it means to be a studio chain.